This is Part 2 of a three-part series on the secondhand clothing market as I see it today, why it’s broken, and what we need to do to fix it.

Part 1 explained why major resale players like Depop and Mercari have been eliminating seller’s fees. The short version? Resale today is fundamentally supply-constrained because selling secondhand is still just too hard. But you should go read that first.

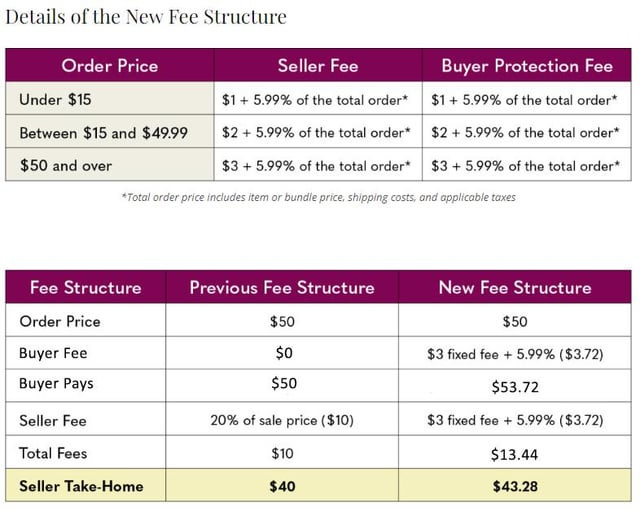

In October 2024, Poshmark announced that they, too, would be dramatically reducing seller’s fees from a whopping 20% to just 6% plus $1-3 (depending on the item’s sales price).

They also, like the others, introduced a “Buyer Protection Fee”, shifting a solid portion of their overall cost of resale from their sellers to their buyers.

I watched all this smugly as I mentally added them to the list of players that I’d include in this piece.

And then less than three weeks later, Poshmark pulled a complete 180 reverting to their original fee structure.

Sellers seemingly hated this change. They very loudly hated this change. Sellers said that their sales dropped off a cliff. And, as Poshmark affirmed in the blog post where they walked back the new policy:

“However, over the past few weeks we have seen that shoppers spent less on purchases as they shifted their spending from orders to fees, leaving our sellers with less cash in their pockets—despite the seller fee reduction.”

So why were low or no seller fees a win for Vinted, Depop, Mercari, and eBay UK, but seemingly a disaster for Poshmark?

Here’s the thing: the sales slowdown Poshmark and its sellers describe is entirely predictable. I think Poshmark just panicked and pulled the plug too soon.

Let’s break down why.

Fees are (somewhat) fungible

No matter who technically pays the fee, it always gets baked into the final price paid one way or another. And it cuts both ways.

If sellers cover the fee, they “mark up” their prices to compensate. Poshmark sellers talk about this all the time.

If buyers cover the fee, they expect a “discount” on the list price to make room for it in their total willingness to pay.

Resellers know this dynamic well. It’s why the same item tends to be listed for less on Depop and more on Poshmark. I even spoke to a founder of a cross-listing platform last week who built this exact logic into their code base.

The First Why: the stages of a price shock

But when Poshmark put those new buyer’s fees into place, they simply got tacked on top of all those existing, already fee-inflated list prices.

Imagine you have a pair of jeans in your cart with a checkout price of $50, and overnight it increases to $57 for no other reason than “f*ck you”. Yeah, that makes you really not want to buy those jeans anymore! You were anchored on $50, and now it just seems like a bad deal. It’s called loss aversion.

There’s no way around it: that change is going to be a short-term price shock. A lot of buyers won’t click “checkout”. Sales drop off a cliff.

But this is only Step 1 of the process. If the marketplace was allowed time to adjust, I’d bet that a few more things would happen from there.

Step 2a.

Given the volume slowdown, Sellers will lower their list prices enough to tempt buyers back in even after those extra buyer’s fees are tacked on. They’ve got to do something to get things moving, right? They’ll grumble about it. Probably a lot. But net-net, it’s entirely possible (maybe even likely!) that despite that downward adjustment to the list price, sellers will still come out ahead than if they had a higher list price but a much heftier seller’s fee to pay.

Step 2b.

Buyers acclimate. Fees that at first feel “extra” get baked into the cake. Extending the same example: if you were anchored on those jeans being $57 from the beginning, then maybe you don’t overthink it and you decide that’s just a fair price to pay.

Step 3.

Between Step 2a and 2b, a new equilibrium is reached. Volume does pick back up, things go back to “normal”, and a portion of Poshmark’s platform fees are successfully shifted from seller to buyer.

It seems to me like Poshmark may have panicked at the intense backlash incurred at Step 1, and pulled the ripcord before Step 2 had time to work itself through. In other words: exactly the wrong moment.

The Second Why: the too-cute trap

Don’t get me wrong: this was far from a perfect plan unfairly foiled by a horde of loud, angry constituents (how *dare* they!?). Poshmark also got way, way too cute.

Notice that all the other platforms I mentioned in Part 1 of this series kept their fee structure simple, at least on the sell side. As a reminder:

eBay (UK): 9-15% seller’s fee to 0% (clothing only)

Mercari: 10% seller’s fee to 0%, with $2 cashout fee

Depop: 10% seller’s fee to 0%

Poshmark went from a flat 20% on sellers to a much more complicated structure. You hate it when they have to break out multiple (!) tables to explain WTF is going on and you’re still left confused.

As a former consultant, I (unfortunately) understand how they got here.

They were probably scared to make the big change of shifting fees entirely from sellers to buyers. So instead of making a choice, they cut the baby in half. 6% on both! Then some asshole in the room suggested 5.99% because it “sounded better”.

The $1, $2, $3 thing was almost certainly meant as a clever measure to disincentivize lower-priced items and shift their inventory higher-end, a common strategy amongst resale platforms these days (more on this in Part 3).

This approach does not endear you to anyone. It made it feel like they were trying to pull one over on someone, and we normies were left to argue over who and by how much.

I don’t blame sellers for being mega-skeptical that this would ever benefit them. And that made the negative backlash from sellers all the louder.

The Third Why: one thing at a time!!!

If you’re going to execute a fundamental shift in the dynamic of your marketplace, you have to have the sense to only do one thing at a time. IMO, for Poshmark that should have been solely to shift fees from sellers to buyers.

Don’t also complicate the structure.

Don’t also try to shift your inventory higher-end.

What do I think happened inside Poshmark during those three weeks? Thanks for asking.

We know sellers were screaming at them. Pressure’s on. Analysts were running around with their heads cut off trying to ~ read the data ~ . All the while the clock is ticking: is volume bouncing back like we think it should!?!

But Poshmark built in so many confounding factors that none of the damn analysts can say exactly what was causing what. Whatever internal conviction they had for the change evaporates. On the other hand, sellers seem very convicted it was the wrong move. At some point, leadership says “screw it, I’m not putting my neck out for this” and backs down.

Or something like that. I don’t know!!! This is pure speculation based on having been in rooms in the past where these types of corporate decisions get made.

But, it certainly smells like panic to me.

BUT WHY?!: Depop, Mercari, eBay (etc.) Ditch Fees For Secondhand Sellers

This is Part 1 of a three-part series on the secondhand clothing market as I see it today, why it’s broken, and what we need to do to fix it. I’m sorry! It just got too long for one piece. But, I PROMISE the rest is coming soon. How do I know? Because it’s already written.

Nobody Wants Your (Cheap) Stuff

This is Part 3 of a three-part series on the secondhand clothing market as I see it today, why it’s broken, and what we need to do to fix it.

“Are you telling me that THIS is the site of a wishy-washy company with an unclear product vision? Couldn’t be!”

Lollll this could apply to so many websites 💀